…and some things we can do to change it.

Deregulation enacted by Republicans and conservative Democrats, and an unprecedented Supreme Court decision allowing corporations the free speech the Founders intended only for flesh-and-blood human beings, led to the majority of Americans steadily sinking economically, as the nation’s wealth flowed to the top. Here are some simple demands to reverse this lethal course, along with a few suggestions of my own following the highlighted portion.

“The demands are pretty damned easy to summarize:

– Reinstate Glass-Steagall

– Audit the FED

– Reverse Citizens United (via Constitutional Amendment)

– Overhaul the tax code for the mega-rich (1%) and corporations”

– “#OWS: Take this video VIRAL, NOW!” Daily Kos, Oct. 9, 2011.

Here are my suggestions:

– End the corporate charter of any corporation that repeatedly or recklessly does harm to their customers or the environment.

– Revamp the rules regarding the appointment of boards of directors to corporations, making shareholder meetings more convenient to attend, or hold them online, and streamline voting procedures so that shareholders can more easily vote on the compensation packages of top executives and who will serve on the corporate board.

– End the practice of buying stock ‘on margin.’ (In other words, you must prove you have the money to pay for any stock you are buying.)

– Stricter enforcement of SEC regulations.

– Tax companies that outsource jobs or other assets overseas at a rate that will remove the profit in doing so.

– Tax offshored assets at the same rate domestic profits are taxed.

– Hold top executives responsible for a corporation’s criminal acts in the same way an individual American would be held responsible. (Example: If an executive approves a heart drug that his company’s internal studies say induces heart attacks, he or she would be as criminally liable as an individual who knowingly provided another person with a drug that caused a heart attack.)

– No corporation that sells equipment or electronics to the government will retain the right to secret proprietary codes or other information on their products.

– Finally, of course, we have to ban corporations from lobbying our government officials and limit the money spent in our elections.

But these suggestions are only a start; perhaps we should rethink the whole concept of the corporation as an entity for doing business as they have now become Too Big to Fail behemoths that threaten our right to life, liberty and the pursuit of happiness and our form of government, and many continue to exist only through taxpayer bailouts. As Ambrose Bierce put it more than a hundred years ago: “Corporation: An ingenious device for obtaining individual profit without individual responsibility.” It’s time we brought back responsibility to the marketplace.

Watch the video here.

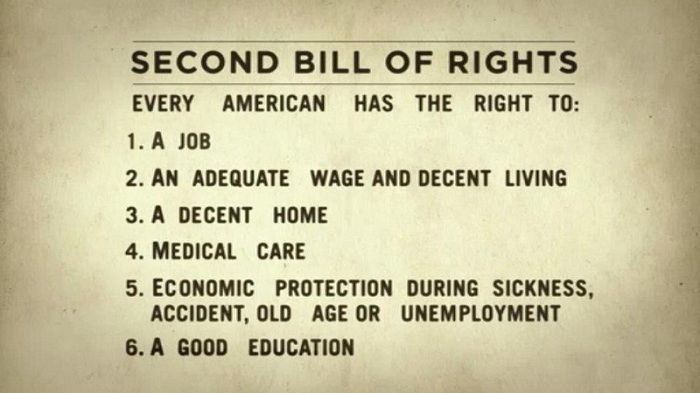

Here’s a simplified version of President Franklin D. Roosevelt’s Second Economic Bill of Rights, proposed in 1944, which, if enacted, would solve a great many of our problems:

RS,

Here’s another one for you. The makers of military hardware, planes, tanks, etc. retain the rights to charge plastic model makers for the use of the designs. Government pays for the design. Government buys, exclusively, the product. Designer charges for the use.

I’m not sure I’m with you on the banning of margin sales. Sometimes people make bad choices, even appallingly bad choices, and there is a line where we need to let them pay the consequences of those bad choices. I’m not exactly sure where that line is, but it’s there.

Instead, there was an idea floated a couple of years ago about a 1 cent per share fee on market transactions. First there’s the revenue raised, the DJI had a volume of 144.3 million yesterday. Next, it will slow or stop the electronic arbitraging of stocks for fractions of a cent. Third, it will drastically reduce profitability of the “pump & dump” penny stocks. Never heard anything more about it.

Comment by db — October 11, 2011 @ 4:56 am

db, I didn’t know about the plastic model thing — that’s incredible.

The problem with buying on margin is if the buyer can’t cover the stock if they are unable dump it off to a bigger sucker. I guess this was more of a problem in the 1920s than it is today.

Comment by RS Janes — October 11, 2011 @ 4:37 pm

In the 1920′s the margin rates were as high as 90%; i.e. $10 got you $100 worth of stock; you borrowed $90. Now the rate is much closer to 50%. The risk to all the players in the entire system is much smaller.

Of course there are any number of high leverage “investments” out there today. But with great leverage comes great risk. That will never change.

Comment by db — October 12, 2011 @ 4:40 am

I haven’t kept up as much as I should on margin rates. You’re right about high leverage and high risk — unless you’re Goldman Sachs. In that case, Uncle Sucker is standing by to save you no matter how big a hole you dig for yourself.

Comment by RS Janes — October 12, 2011 @ 5:31 pm

RS,

Forgive me if I blather on, but there is a difference between saving “Wall Street” and saving the “function” of “Wall Street”. Back in 2008 there was a real possibility that Bank of America, AIG, & Citigroup would fail.

For the banks, think of the dislocation if starting tomorrow, your checks drawn on that bank are not honored. You have the money in the account, but the bank is no longer in business. I mailed out checks for the power & mortgage yesterday. You no doubt did similarly. Then multiply by millions. Just imagine the dislocation.

For AIG, they sell insurance & annuities. Imagine that your insurance company goes broke. All of a sudden your car/house/life isn’t insured. If your luck runs like mine, that’s the time disaster will strike. At what risk to how many? With annuities, people had paid good money for the product, usually tied to retirement. Are they SOL? What then? Do we let them starve?

President Bush, & later President Obama with the Auto Companies, decided that preserving the institutions of BOA, AIG, & Citi were important to the country and the dislocations & problems of allowing any of them to go bankrupt warranted intervention. I happen to think he was right.

My disagreement was that President Bush did not tie the aid to severe limitations on executive pay & bonuses.

I’d be glad to continue this. Privately if you choose.

Comment by db — October 12, 2011 @ 8:25 pm

db, I agree with you; Obama was forced by circumstances to bail out the banks or face the nightmare scenario you outlined. Of course, Goldman Sachs is not, and shouldn’t be considered, a bank — it’s an investment house and it’s disappointing that Obama didn’t take the opportunity of the bailout crisis to return to Glass-Steagall and separate commercial banks from investment firms. GS, et al, would still have to have been bailed out to save the markets and the economy, but we could have prevented future dislocations and collapses. I also agree that Obama should have put strict limitations on executive pay, etc., when he had the chance. (I don’t think it was in Bush’s blue-blooded DNA to ever do such a thing — his brother Marvin ‘worked’ on Wall Street.) You can respond privately or here; I’ll leave it up to you.

Comment by RS Janes — October 13, 2011 @ 5:46 am