October 27, 2011

October 11, 2011

April 23, 2011

The Top Five Corporate Tax Cheats

Before pushing grandma down the stairs by ‘reforming’ her Medicare and Social Security benefits out of existence, why not go after these god-awful drains on our treasury? Here are five examples of profitable corporations that pay no or low federal income taxes, yet extract much of their profit margin from the American economy. It’s past time for them to pay, as a percentage of their income, at least as much as the average public school teacher or firefighter in Wisconsin.

Want to balance the budget? Start here:

1. General Electric has made over $26 billion in profits in the past five years, with $5 billion from the US market just last year, on which it paid zero federal income taxes. It’s also received a hefty $4.1 billion refund from the IRS. Despite this generosity on the part of the American taxpayer, over the last nine years GE has shipped one-fifth of its jobs overseas and used every trick available to avoid paying US taxes. This is bringing good things to life? (BTW, Jack Welch, former CEO of GE, is sometimes called the father of modern outsourcing.)

2. ExxonMobil. This oil giant paid no federal income taxes in 2009 on $19 billion in profit, and even received a tidy $156 million rebate from the IRS. How do you get a tax rebate when you haven’t paid any taxes? On what planet does this make any sense?

3. Goldman Sachs paid only 1.1 percent in taxes on a profit of $2.9 billion in 2008, on top of the $800 billion provided by US taxpayers to save them from extinction. Time for another bonus, boys?

4. Citigroup ‘earned’ more than $4 billion in profits last year, yet paid no federal income taxes. Incidentally, like Goldman Sachs, they’re only in business thanks to a generous bailout from the US taxpayer; for Citigroup, that came to a neat $2.5 trillion. Despite this, Citibank continues to raise its fees and specialize in providing poor service to its customers.

5. Bank of America racked up $4.4 billion in profits last year, and received a $1.9 billion refund from the IRS. Since US taxpayers saved BoA from extinction with a $1 trillion bailout, why are they getting a $1.9 billion refund? I’m tired of asking on what planet this makes any sense.

And this is only the tip of our economic Titanic’s iceberg. If we’re going to have any future that doesn’t include our citizens rooting through dumpsters for dinner, these profitable corporations, et al, and the wealthy people who run them, are going to have to pay their fair share in taxes. For some reason, Paul Ryan forgot to include this in his hilarious Republican ‘budget.’

(Figures adapted in part from Sen. Bernie Sanders’ “Guide to Corporate Freeloaders.”)

© 2011 RS Janes. LTSaloon.org.

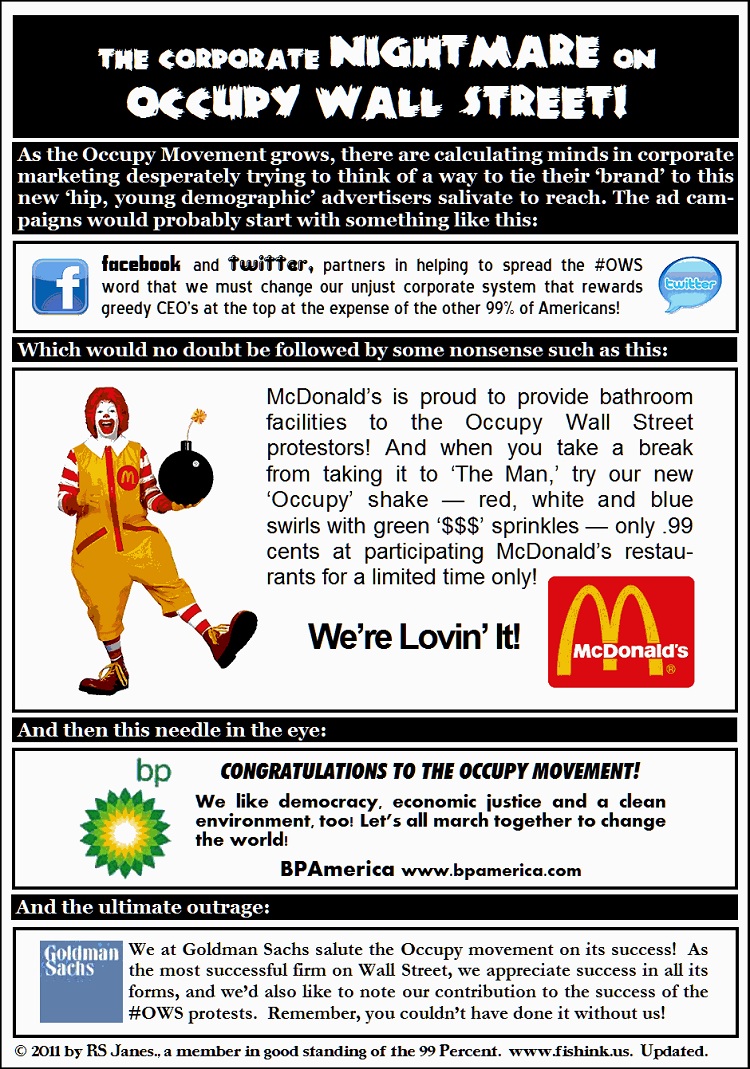

Boycott Burger King

It makes sense they’d refuse the Wall Street protestors; Burger King was once owned by the original Home of the Whopper, Goldman Sachs (they sold it to 3G Capital in 2010), and they treat their employees abysmally (see video below from Brave New Films). Meanwhile, McDonald’s and neighborhood places are allowing the OWS to use their bathrooms (and are making a tidy profit from selling them food and drink). Good for them. Let’s make this a nationwide boycott of Burger King until they side with the 99 percent and treat their workers better.

See the video here.