Author’s note: This article was originally published on the Madison Independent Examiner. There is a slideshow and video for viewing there. You may recognize some of the images from this site. The video is very informative and I encourage you to check it out. It is about time Americans demand that mega-corporations and the super-rich pay their fair share of the tax burden.

It has been widely reported since at least 2010 that U.S. corporations and the wealthiest Americans have taken advantage of tax loopholes by hiding their assets in offshore subsidiaries (a.k.a. tax havens) in order to avoid paying U.S. income taxes. The amount of money hidden in these tax havens and what the lost revenue means to the American people has not been so widely reported.

According to several sources, including the BBC, the non-partisan Congressional Research Service (CRS) and James Henry, former Chief Economist at McKinsey & Company, the top 1% of wealthiest Americans and corporations have deposited between $21 and $32 trillion in tax havens in order to evade U.S. taxes. The top seven U.S. banks, furthermore, account for over $10 trillion in assets in more than 10,000 overseas subsidiaries.

Assuming these figures are correct, if all of these assets were taxable, then the U.S. could collect billions, perhaps trillions in additional revenue each year.

Data from the Bank of International Settlements (BIS), the International Monetary Fund (IMF), the World Bank, and several governments are used in that assessment. (See video at source). CRS’s report focuses on five small countries generally considered to be tax havens (the Netherlands, Luxembourg, Ireland, Bermuda and Switzerland) and compares them to five of the top “traditional” foreign countries where American companies actually do business (Canada, Germany, the United Kingdom, Australia and Mexico).

While any knowledgeable person knows that U.S. multinational corporations engage in tax avoidance by shifting their profits into tax havens, not many know exactly how that is done. The waters are further muddied by CEOs and corporate lobbyists who either deny that outright or use the standard industry mantra: “Our company pays all applicable taxes in every jurisdiction where we operate.”

The practice of using tax havens is somewhat simple and is legal under current tax codes, but that does not make the practice morally right or even ethical. Corporations and banks simply need to shift their profits by conducting transactions in countries with little or no corporate taxes. U.S. tax codes allow a “deferral” on paying taxes in the U.S. until the funds are actually brought back to the U.S. and in most cases, they never are.

A classic example of tax haven abuse is the common practice of registering subsidiaries in the Cayman Islands. With more than 85,000 companies registered there, it is one of the few territories in the world that has more organizations than inhabitants.

Mitt Romney’s Caymen Island accounts garnered some scrutiny during last year’s Presidential election. Facebook sheltered $700 million in the Cayman Islands in 2012, while posting over $1 billion in profits and paying no taxes in the US. In fact, 26 of the 30 largest U.S. corporations that utilize subsidiaries paid no income tax between 2008 and 2011, including GE, Boeing, Verizon, Bank of America and Goldman Sachs. The banks on the list, ironically, were bailed out by U.S. taxpayer money.

It can be correctly argued that the U.S. has the highest corporate tax rate in the world at 39.2% when both federal, state and local taxes are included. That, however, means very little in terms of actual taxes paid when corporations and the top 1% hide most of their profits and assets in offshore tax havens. Smaller corporations, small businesses and the bottom 99% of individuals are generating more than their fair share of revenue than are large corporations and the top 1%.

Conservative estimates of lost federal revenue due to offshore tax havens are about $150 billion per year, but that does not take into account what the states lose. A U.S. Public Interest Research Group (PIRG) report estimated that states lost nearly $39.8 billion in revenues in 2011, bringing the total to about $190 billion annually. Of that total, corporations were responsible for about 65% in lost revenues to tax havens, while wealthy individuals were responsible for the rest.

To put that in perspective, $39.8 billion would cover education costs for more than 3.7 million children for one year. This sum is also roughly equivalent to total state and local expenditures on firefighters ($39.7 billion) or on parks and recreation ($40.6 billion) in 2008. The U.S. national debt is closing in on $17 trillion and the sequester cuts total about $22 billion. $150 billion in additional federal revenue would make sequester a moot point and remove austerity from the national political vocabulary. The government could then move on to addressing the real problem in the economy – lack of well-paying jobs.

In his book, The End of Poverty, Jeffrey Sachs estimated that in order to end extreme world poverty it would cost $175 billion per year for the next 20 years, a total of $3.5 trillion. In other words, the wealthiest corporations and individuals have enough in offshore tax havens that they could do that now and still retain most of their assets. Taxing 65% of between $21 and $32 trillion in profits and assets at a rate of 39.2% could also provide more than enough to do that.

Dropping food instead of bombs on impoverished nations, true humanitarian projects such as helping to provide clean drinking water and electricity, instead of facilitating regime change in third world countries, may help to repair the U.S. image in the world and reduce terrorism. A better world image may even reduce the need to spend more on defense than the next 13 nations combined. As things stand now, unfortunately, the U.S. does not have enough revenue to help its own people.

The same businesses that avoid paying taxes are also the ones that benefit from educated American workers, an infrastructure that aids in the transportation of goods, services and transactions, and the security that the publicly-funded police and military provide on both a local and global level.

Yet corporations, banks and wealthy individuals have no problem with avoiding paying their fair share of taxes, thereby dumping the tax burden on the working poor, middle class and small businesses. Meanwhile Americans are looking at cuts in social services such as Medicare and Social Security, a crumbling infrastructure, an underfunded educational system, a higher deficit and higher taxes.

It is about time for Americans to demand that lawmakers put the brakes on the free ride that huge corporations and the top 1% have been getting for the past few decades.

Get links, sources, a slideshow and video here: Madison Independent Examiner – Closing corporate tax havens: The solution to the sequester (and world poverty)

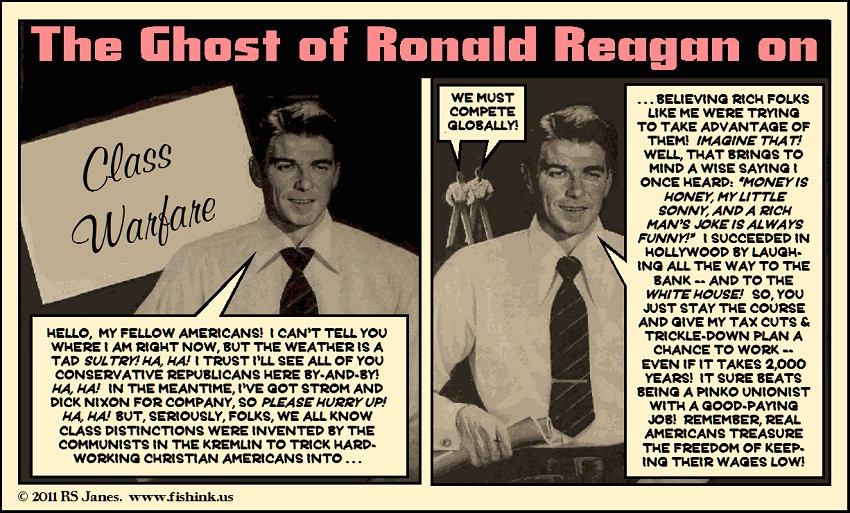

The Self-Delusions of the Wealthy: Are They Really Worth What They’re Paid?

“If the wealthy had to work as hard as the janitor, they’d demand enough money to hire someone else to do the job.”

– Richard Sherricky

As summer slides into fall, if not the financial fall that’s eventual, some things haven’t changed, such as the investment bank aristocracy of Wall Street, already wallowing in obscenely large salaries, apparently believing they actually earn their pay for continuing to peddle worthless paper and hoodwinking their own customers. This addled belief, however, is nothing new.

Having misspent a part of my youth as an advertising executive at a publishing company, I once had an opportunity to encounter wealthy people at business lunches and social functions, and noticed a few habits of hypocritical thinking most of them had in common:

– To a man — and they were all men back then — they believed, even the silver-spoon trust fund scions and coddled bosses sons, that they were ‘self-made’ and everything they had was attained by their own hard work, even if their wealth was derived from dividend income, the result of a long-dead relative fortunately picking the right investments or starting a successful business.

– Speaking of hard work, when these CEOs and corporate presidents drifted in at 10 or 11 in the morning to check the mail and sign a few letters, left for a two-hour lunch at 12:30, and then went golfing for the rest of the afternoon, leaving their overworked and underpaid secretaries to run the place, they would still insist that they had ‘worked hard’ all day. The trust fund scoundrels were even worse; they’d sit in a quiet bar in the afternoon hunched over a drink, or lounge at home in their bathrobe, and their ‘work’ for the day consisted of a few calls to the office to see if everything was all right. As usual, a secretary or senior manager was running the company.

– Whatever their educational institution, Ivy League or state university, they all thought they graduated because they ‘studied hard’ and ‘put their noses to the grindstone’ even though some would laughingly brag, after a few too many cocktails, about how they had hired poor ‘scholarship brainiacs’ or ‘eggheads’ to teach them how to cheat on their tests.

– While most of them abhorred any publicly-funded program that enabled poor kids to get a better education, and especially affirmative action, they were blind to their own advantages, beyond just being born white. If Uncle Joe picked up the phone to make sure they got into the ‘right’ college, or Daddy was once a student and fast-tracked their ‘legacy’ acceptance into a good university, that was fine — just the way the world worked. Of course, left unsaid was how they would have been able to make their way through college if such financially-strapped ‘scholarship brainiacs’ were not there to help them cheat, just one of many mental cul-de-sacs that these sons of privilege passed by quickly, lest they get caught on their own conundrum.

– Although most of them supported the war in Vietnam, none of them came close to serving in it. They either received school draft deferments like Dick Cheney; or, like Rush Limbaugh, had a note from the family doctor describing some dread condition that made them militarily unfit, but somehow didn’t interfere with their golf game. Others had a family-friend Congressman intervene to keep them out; or, like Junior Bush, had the Old Man pull a few strings to get them ‘Weekend Warrior’ duty in the National Guard. Privately, they had little regard or compassion for the troops in the field; in fact, they believed them stupid and that the grunts should show gratitude for the opportunity that military service provided to raise their lowly selves out of the ghetto or trailer park. Should they die or be maimed for life during this process of elevation – well, that’s just the price they pay for not having the foresight to be born in better circumstances.

– Most of them hated paying taxes, the hatred much more intense than that of those lower on the income ladder. Like Leona Helmsley, they thought taxes were fine — for the ‘little people.’ A couple of them were even said to spend more money on lawyers and accountants to avoid paying taxes than the amount they owed in taxes. But they didn’t mind one bit freeloading off poorer folks by using roads, highways, airports, parks, sewer lines and other public facilities partly paid for by the taxes of the non-rich; and they took it for granted their class would receive preferential treatment from cops and firefighters they didn’t want to pay taxes to support. I won’t even get into the courts, prosecutors, and military all arrayed to protect their property that they also didn’t want to pay to uphold — suffice it to say that they didn’t believe in any taxes for themselves, even for those things that benefited them greatly. It would be a mistake to take this as any sort of reasonable consideration on the subject of taxation; it was not – it was a nearly-hysterical emotional reaction born of mindless greed or sheer obtuseness.

Because of my position at the time, I couldn’t easily debunk or refute their various delusions and fits of psychological zoanthropy; to do so might affect my company and my employment there and, frankly, I needed the job. While I would pose a mild question or two — nothing too challenging or confrontational — I mainly just listened to their hallucinations. Two of the great common myths of American culture are that you can’t be too rich or too thin. Anyone who has seen a person dying of anorexia knows the first is false, and anyone who has encountered the wealthy as I did knows that an excess of money can be just as harmful to a healthy mind as eating nothing but candy is to the body. One thought, unexpressed, went through my mind repeatedly as I listened and watched these well-heeled business acquaintances go through the motions: what exactly do these people do that is worth so much money? One-thousand dollars an hour or more for calling into the office or letting your secretary handle things? Doling out a few million to someone who cured cancer would seem appropriate; but paying that to a man who rarely worked and took months off for vacation while begrudging his employees a slight raise and a couple of weeks off for a holiday? It was outrageous and the situation has worsened in the decades since these events happened. Then, top executives received about 50 times more than the average worker; today, it’s about 700 times. Yet, are they working any harder than the top execs of the mid-70s? I’d bet Lloyd Blankfein’s yearly salary of $55 million they aren’t.

(Incidentally, I’m exempting here those who really did start their own businesses from scratch with next to nothing. They worked hard getting the place running and deserve to be paid for their effort if they succeed. That said, I don’t know if that effort is worth billions, but that’s a question for another time. Also, I’m not taking a swipe at artists, entertainers or sports stars; most of them also worked hard to get where they are, generally have brief professional lives, and merit compensation for their talents since it’s usually based on public approval rather than a board of directors stocked with your cronies.)

Until executive compensation is brought into line with actual worthwhile work done, and the wealthy have to pay their fair share of taxes, including payroll taxes and capital gains taxes commensurate with what the average worker pays, I don’t think we can resolve our current economic mess.

That aside, the thread running through all of this is the massive degree of self-delusion practiced by those with wealth. It’s scary enough when they know they’re lying to make a buck; it’s pathologically dangerous when they buy into their own fantasies about themselves as have, it seems, the current crop of Wall Street bunco artists and banking grifters. In this case, it won’t end until Richie Rich, ensconced in an office at Goldman Sachs, dreaming up the next fraudulent financial instrument for his firm to foist on the gullible markets, hits bottom – an inevitability since they refuse to learn from their mistakes — and seeks another ‘loan’ from the contemptible ‘little people’ who pay taxes via the federal Big Daddy and, to mix metaphors, the cupboard is bare.

Then these Masters of the Universe will learn the tough lesson the cosseted Junior Bush as president had to endure: there are times when even Big Daddy can’t save you from the hard consequences of acting like a spoiled brat with too much for your own good.

© 2011 RS Janes.

www.fishink.us