A friend of mine just told me about a friend of his who, for the past several years, has had to spend every single weekend of his life cooped up in jail. Every single weekend, week in and week out, this guy goes to jail — with free room and board provided at the taxpayers’ expense. “But, why?” you might ask. Because the guy steadfastly refuses to pay that portion of his federal income tax that goes toward unnecessary wars.

But many huge US-based multi-national corporations also refuse to pay any kind of federal tax at all. So shouldn’t their CEOs be spending weekends in jail as well? https://www.youtube.com/watch?v=voIFj8X-Mj4

Taxes are supposed to be a way that all of us Americans can pool our money together in order to buy all that expensive stuff that we couldn’t afford to buy individually. For instance, I alone cannot afford to purchase good roads, education for my granddaughter, police and fire protection, etc. all by myself. And neither can most of the rest of us either. And for this obvious reason I approve of taxation. https://www.youtube.com/watch?v=w3_pR6fcELU

But apparently a lot of huge mega-corporations have refused to pool their money with our money so that we can all afford to pay for these big-ticket items. Corporatists have a better idea: “Let’s just let everyone else pay for our share.” http://www.newyorker.com/arts/critics/books/2014/03/31/140331crbo_books_cassidy?currentPage=all And then you can hear them whispering to themselves under their breath, “Suckers.” http://www.thenation.com/blog/179357/tax-breaks-are-killing-planet

April is tax season, of course, but it is also Passover season too. And this Passover, I was once again amazed by the poetry and meaningfulness of the Haggadah ritual words recited at Seder dinners throughout the world.

According to the Haggadah, Jews everywhere strongly believe that freedom is the birthright of every human being alive — and not just Jews. “With freedom and justice for all.” Even for dark-skinned Jews in Israel and even for Christian and Muslim Palestinians. Yay! And even for us tax-paying Americans too. http://www.haaretz.com/print-edition/news/jerusalem-christians-are-latest-targets-in-recent-spate-of-price-tag-attacks-1.413848

PS: At last month’s Berkeley-Albany Bar Association luncheon, our guest speaker told us all about the latest changes that have been made in federal tax law. I madly scribbled all this stuff down on some paper napkins and here it is. Hopefully I got most of it right:

“The IRS budget for 2014 was slashed by $526 million. It now has 8,000 fewer employees — but with a much bigger workload. Last year there were 3.5 billion dollars in fraudulent tax returns. And the IRS admits that it conducted 18 percent fewer audits of major corporations last year.” Told ya.

“Not many tax laws were passed last year.” Hell, not many of any kind of laws were passed last year by this do-nothing Congress — except for a whole bunch of laws sending Big Government into our bedrooms.

“The American Taxpayer Relief Act of 2012 (ATRA), passed in 2013, permanently extends a lower tax rate on individuals with incomes of $400,000 or less. It also provides for a new 39.6% marginal rate for income in excess of the above thresholds, as well as a higher rate for net capital gains and qualified dividends. And for a phase-out of personal exemptions and itemized deductions for higher-income individuals. But even with these new increases, US tax rates are still quite low in comparison with other countries.”

“Regarding foreign income reporting, there is now a Form 8938 which requires that specified foreign financial assets must be reported.” About time for that to happen! “And the penalties are stiff if you fail to file an accurate 3938.” Good. “And there are no statutes of limitation here either. Pursuit of US taxpayers with foreign financial accounts continues to be one of the IRS’s highest priorities.” But the IRS is also trying to extend its statutes of limitation in other areas too. So be aware of that.

Regarding gay marriages, “Same-sex couples, legally married in jurisdictions that recognize their marriage, will be treated as married for all federal tax purposes.”

And apparently America’s fourth-largest tax preparation firm just got busted for fraudulent and deceptive conduct and isn’t gonna be allowed to prepare our taxes ever again. “One of the more heinous acts committed by the owner involved forging customers’ signatures on duplicate refund checks, causing collection proceedings against the customers, who knew nothing about this.”

Also, when filing out your 1040, make sure you check “child support” and not “family support” because spousal support doesn’t count as child support and apparently doesn’t get as many reductions.

“The IRS assessed FBAR penalties against a taxpayer for willingly failing to report the existence of or the income from a Swiss bank account.” And the IRS has taken a very hard line regarding overstated charitable contributions too. And California taxes its residents on their world-wide income as well.

“S corporations have done well under the new tax act — exempt from healthcare taxes, etc. They won’t be going away any time soon.” No idea what an S corporation is but apparently it is a good thing to have if you are going to pay taxes.

“And roll-overs are tricky. Be very careful. You only have 60 days.” And home offices aren’t so much the audit-trigger that they once were under the new safe harbor rule — as the IRS attempts to codify repairs and improvements to small businesses.

And then the speaker also explained a lot of stuff about ObamaCare and its effects on our taxes — but I got distracted by the cheesecake for dessert.

PPS: One tax preparer told me that I owed $600 in taxes for 2013. Another one said that I didn’t owe anything at all. Guess which one I believed?

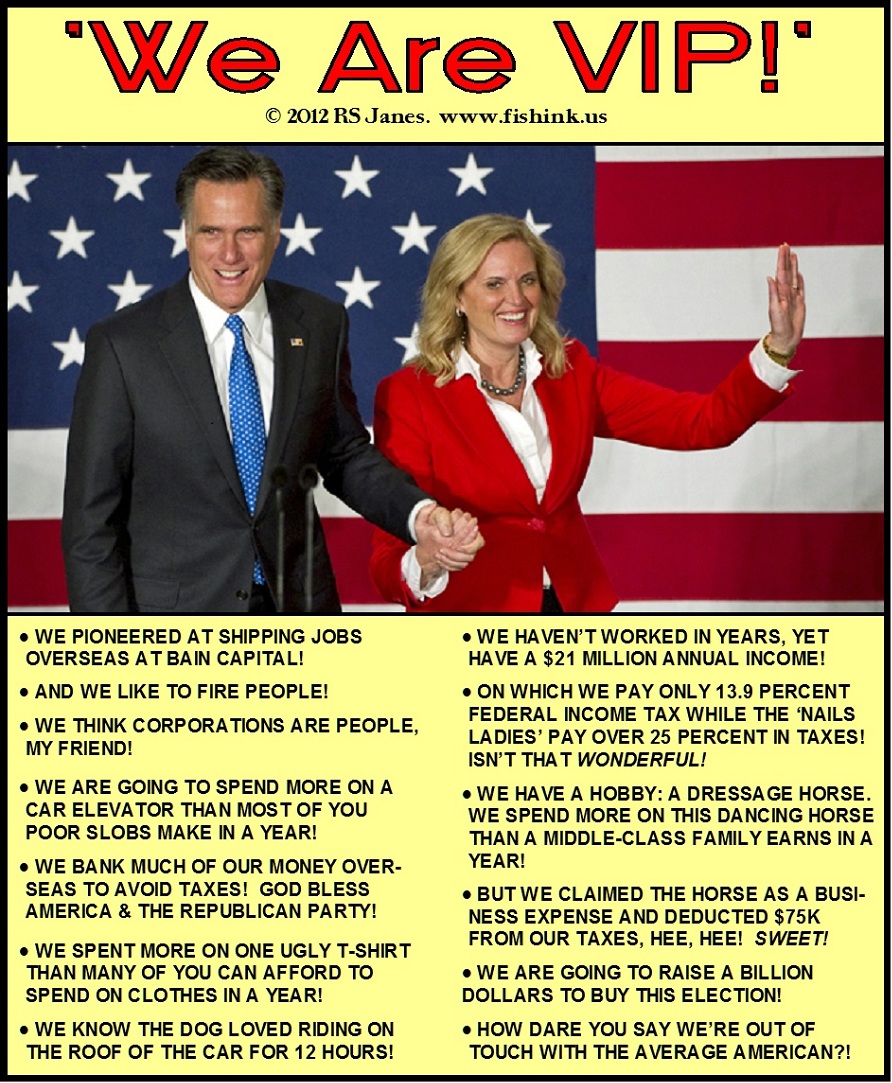

The Tattlesnake – Clueless Wall Street Indulges in the Self-Delusion of the Wealthy Edition

… and it’s nothing new.

As 2011 settles in, some things haven’t changed, such as the investment bank aristocracy of Wall Street, already wallowing in obscenely large salaries, apparently believing they deserve bonuses for continuing to peddle worthless paper and hoodwinking their own customers. This addled belief, however, is nothing new.

Having misspent a part of my youth as an advertising director for a publishing company, I once had an opportunity to encounter some wealthy people at business lunches and dinners, and noticed a few habits of hypocritical thinking they had in common:

– To a man — and they were all men — they believed, even the silver-spoon-born trust fund scions and coddled bosses sons, that they were ‘self-made’ and everything they had was attained by their own hard work, even if their wealth was derived mostly from dividend income, the result of a long-dead relative picking the right investments or starting a successful business.

– Speaking of hard work, when these VIPs came in at 10:am to check the mail and sign a few letters, left for a two-hour lunch at 12:30, and then went golfing for the rest of the afternoon, leaving their overworked and underpaid secretaries to run the place, they would still insist that they had ‘worked hard’ that day.

– Whatever their educational institution, Yale or Harvard or a state university, they all thought they graduated because they ‘studied hard’ and ‘put their noses to the grindstone’ even though some would laughingly brag, after a few too many martinis, about how they had hired poor ‘scholarship brainiacs’ or ‘eggheads’ to teach them how to cheat on their tests.

– While every one of them abhorred any publicly-funded program that enabled poor kids to get a higher education, and especially affirmative action, they were blind to their own advantages, beyond just being born white. If Uncle Joe picked up the phone to make sure they got into the ‘right’ college, or Daddy was once a student and fast-tracked their ‘legacy’ acceptance into a university, that was fine — just the way the world worked. Of course, left unsaid was how they would have been able to make their way through college if such financially-strapped ‘scholarship brainiacs’ were not there to help them cheat, just one of many mental cul-de-sacs that these sons of privilege passed by quickly, lest they get hung on their own conundrum.

– Although all of them supported the war in Vietnam, none of them came close to serving in it. They either received school draft deferments like Dick Cheney; or, like Rush Limbaugh, had a note from the family doctor describing some dread condition that made them militarily unfit, but somehow didn’t interfere with their golf game; or had a family-friend Congressman intervene to keep them out; or, like Junior Bush, had Daddy pull a few strings to get them easy ‘Weekend Warrior’ duty in the National Guard. Privately, they had little regard or compassion for the troops in the field; in fact, they believed them stupid and that the grunts should show gratitude for the opportunity that military service provided to raise their lowly selves out of the ghetto or trailer park. Should they die or be maimed for life during this process of elevation – well, that’s just the price they pay for not having the foresight to be born in better circumstances.

– They all hated paying taxes, the hatred much more intense than that of those lower on the income ladder. Like Leona Helmsley, they thought taxes were fine — for the ‘little people.’ A couple of them were said to spend more money on lawyers and accountants to avoid paying taxes than the amount they owed in taxes. But they didn’t mind one bit freeloading off poorer folks by using roads, highways, airports, parks, and other public facilities paid for by the taxes of the non-rich; and they took it for granted their class would receive preferential treatment from cops and firefighters they didn’t want to pay taxes to support. I won’t even get into the courts, prosecutors, and military all arrayed to protect their precious property that they also didn’t want to pay for — suffice it to say that they didn’t believe in any taxes for themselves, even for those things that benefited them greatly. It would be a mistake to take this as any sort of reasonable consideration on the subject of taxes; it is not – it’s a nearly-hysterical emotional reaction born of mindless greed.

That’s all I can recall at the moment, but the one thread running through all of it is the massive degree of self-delusion practiced by those with wealth. It’s scary enough when they know they’re lying to make a buck; it’s pathologically dangerous when they buy into their own fantasies about themselves as have, it seems, the current crop of Wall Street scoundrels. In this particular case, it won’t end until Richie Rich, ensconced in an office at Goldman Sachs, dreaming up the next fraudulent financial instrument for his firm to foist on the gullible public, hits bottom – an inevitability since they refuse to learn from their mistakes — and seeks another ‘loan’ from the contemptible ‘little people’ taxpayers via the federal Big Daddy and, to mix metaphors, the cupboard is bare.

Then these Masters of the Universe will learn the tough lesson the cosseted Junior Bush as president had to endure: there are times when even Big Daddy can’t save you from the hard consequences of acting like a spoiled brat.

© 2011 RS Janes. LTSaloon.org.